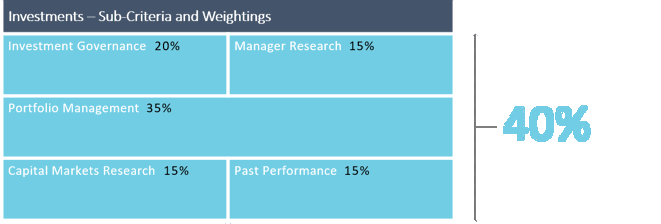

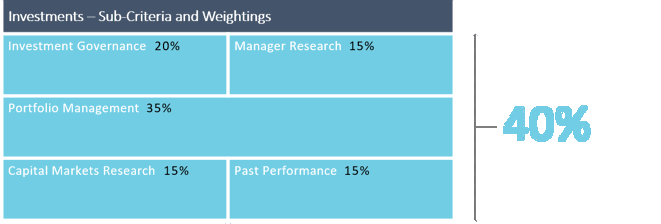

Chant West’s annual Super Fund Awards night is fast approaching, and in recent months we have been busy re-evaluating our ratings of funds across a range of criteria. The most important of these criteria remains investments, because how funds invest has the greatest bearing on the eventual outcomes of their members. For that reason, investments carries a weighting of 40% in our overall rating scores.

The ratings process, which informs our awards, is always a time for reflection. And when we assess investments, portfolio management carries the greatest weight of all the criteria, as shown in the Chart below. In particular we focus on how well funds succeed in having their ‘best ideas’ incorporated in their portfolios.

In this article, we want to focus mainly on portfolio structure trends over time and the consequences of those changes.

Trending away from traditional sectors

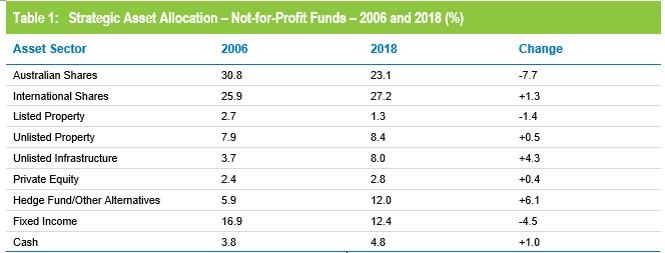

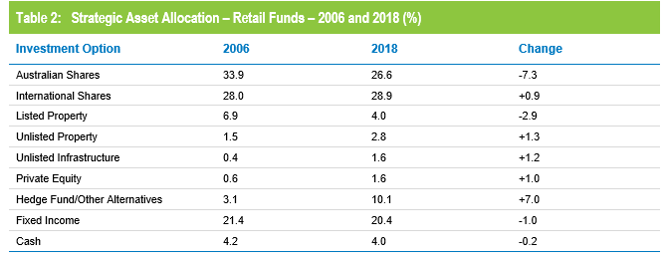

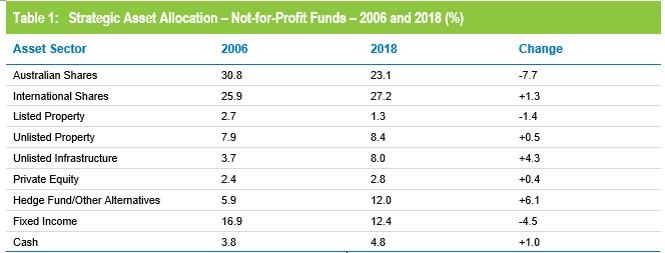

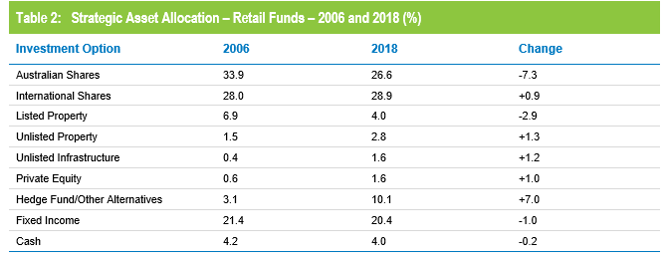

Over the past decade and more, we have witnessed a significant shift away from traditional asset sectors as funds have sought new ways to drive returns and lessen risks. Those shifts are reflected in Tables 1 and 2 below. They show the average strategic asset allocations when we first published our Strategic Asset Allocation survey in 2006, and compare those with our latest survey at December 2018 based on our traditional ‘Growth’ universe (61% to 80% growth assets).

Table 1 shows the allocation changes for not-for-profit funds and Table 2 shows the equivalent changes for retail funds. It should be noted that most of these retail funds’ investment options aren’t their MySuper defaults as they tend to adopt a lifestage model for their MySuper offerings.

The most striking changes are:

The reduced allocations to Australian shares. Funds have traditionally had a significant home bias in their equities exposure, partly due to the favourable tax treatment of franked dividends from Australian companies. More recently, they have recognised the limitations of the Australian market because of its concentration on financials and resources, and the much larger opportunity set that exists internationally. Funds on average now have higher allocations to international shares than they do to the local market, and it could be argued that further moves in that direction may be warranted.

The reduced allocation to traditional fixed income, ie bonds. This is far more pronounced in the case of not-for-profit funds which, in recent years, have directed more of their defensive allocations towards unlisted property, unlisted infrastructure and defensive alternatives. (We have commented previously on these sector classifications – see our September 2018 survey article for more insights.)

The increased allocations to non-traditional asset sectors in the form of hedge funds and other alternatives. This is true across both not-for-profit and retail funds, although the not-for-profit segment led the way in this development with retail funds playing catch-up. Retail funds have preferred to invest in these more liquid alternatives rather than illiquid unlisted assets.

Retail funds continue to invest significantly less than not-for-profit funds in unlisted infrastructure, unlisted property and private equity (6% versus 19%).

Diversification and performance benefits

Having seen how funds have shifted their strategic allocations, we can now look at some of the consequences. Super funds – led by the not-for-profit segment – have done an excellent job over the past 12 years in further diversifying their portfolios. By seeking out new sources of return they have become less reliant on listed markets, and as a result their portfolios have become more resilient.

We saw a good illustration of that in the last quarter of 2018, when listed markets went into a sharp decline. In that 3 month period, Australian shares fell 8.4%, international shares fell 13.3% (hedged) and 11.1% (unhedged). Yet the median growth fund limited the damage to just 4.6%. The not-for-profit segment limited the loss to 4.4%, cushioning the blow more than retail funds which lost 5.2%. This was largely due to the not-for-profit funds’ higher allocation to unlisted assets – mainly property, infrastructure and private equity – which all posted positive returns for the quarter.

While listed markets rebounded strongly over the March quarter, resilience is valuable for members by providing some downside protection when listed markets turn negative. But of course positive performance is what matters over the longer term, and some of the allocation shifts by funds have also enhanced their members’ longer-term returns.

For example, the decision by some not-for-profit funds to reallocate some of their fixed income exposure into defensive unlisted and alternative assets has been vindicated by the relative performance of those sectors. Similarly, the reduced allocation to Australian shares and accompanying increase in international shares by the industry as a whole have come at a time when the local market has underperformed international markets, so again that has been a positive for performance.

Lifecycle models are evolving and improving

Another development that has influenced our assessment of portfolio structure is the introduction and growth of lifecycle solutions, which now account for more than a third of all MySuper assets. The lifecycle model is a relatively new development and, not surprisingly, these products continue to be refined as some of the earlier design deficiencies are recognised.

One important improvement is in the area of transition, in other words the way in which members have their asset allocations de-risked as they become older. Some of the earlier designs featured abrupt changes in allocations as members were transitioned from one risk category to another at a set age, which introduced unwanted risks.

Most retail funds have adopted a different ‘cohort’ approach, where members are allocated to a particular investment option (cohort) according to their date of birth. They remain in that same option throughout their membership, but the option itself has its asset allocation gradually de-risked. The problem is that the 10-year cohort age band, used by several large retail funds, tends to be too wide as it means that members born nearly 10 years apart have the same risk profile. Conversely, members born a few days apart may have significantly different risk profiles. The use of 5-year cohorts by some other retail funds mitigates this issue somewhat.

While these early models are still most commonly used, other designs incorporate more sophisticated approaches. Good examples are Sunsuper, QSuper, Australian Catholic Super and MLC’s recently launched MySuper strategy.

The new MLC offering also addresses another common shortcoming of the early lifecycle products, which is premature de-risking. Many of the early products had members’ growth/defensive split reducing to 30/70 or even 20/80 by age 65, presumably on the premise that some members will need to access a significant portion of their money soon after retirement, and so could afford very little risk. This overlooks the fact that a 65 year old still has a life expectancy of close to 20 years and is likely to leave some or all of their balance invested in the fund as they move into the pension phase. It also overlooks the availability of the Age Pension, which for those who can claim it acts as a Government-guaranteed defensive component that increases over time. Indeed, it is for these reasons that most not-for-profit funds have not felt the need to reduce growth assets for their older default members.

MLC has recognised these issues and has come up with what we consider to be a more appropriate glidepath. Up to age 55 members have an 85% allocation to growth assets. Gradual de-risking then occurs between 55 and 65, resulting in a 70/30 growth/defensive split at age 65. From that point there is no further de-risking.

Growth of internal teams and the need for good governance

We have long maintained that there is no ‘best’ approach to investments. Some of the most successful funds differ widely in their models, and that diversity is healthy. We see it every year at our Awards presentations where the short-listed funds for ‘Best Fund: Investments’ – last year’s being AustralianSuper, Hostplus, QSuper and UniSuper – all have their own distinct investment beliefs, structures and processes.

There is one vital quality, however, that all the best funds exhibit and that is good governance. Governance takes on even greater importance at a time when funds are experiencing rapid growth in their assets under management and, in many cases, in the size and responsibilities of their in-house investment teams. That is why governance carries a substantial 20% weighting in our overall investment scores.

With internal expertise on the rise, more and more decisions are being delegated to those teams by the funds’ Investment Committees. That, in turn, has necessitated changes in the composition of those committees themselves. Whereas they might once have included all Board members or perhaps a subset of the Board, now they require more in-depth investment knowledge and expertise so as to be able to question and challenge recommendations coming from the internal team. Increasingly, therefore, we are seeing funds adding experienced independent investment professionals to their committees, and we consider that a healthy development.

While internal expertise is on the rise, external asset consultants still have an important role to play. Asset consultants are valuable repositories of information and insights into capital markets and investment managers, among other things, and part of our investments rating relates to the quality of a fund’s consultants and how their expertise feeds into the decision-making process.

Consultants themselves have changed their business models in response to changes in demand from their client funds. They have had to become more flexible in their service offerings. As an example, with growing internal investment teams that want to conduct their own analysis, we have seen asset consultants invest heavily in technology so that clients can access their research and modelling through online tools.

Traditional consulting arrangements do still exist, but we are seeing a growing number of funds (mainly medium and larger funds) engaging one or more specialist consultants or research providers to take advantage of their particular expertise, especially in areas such as private equity, property and infrastructure.