Following an up and down September quarter, super funds bounced back strongly in October with the median growth fund (61 to 80% growth assets) up 3.2% for the month. This brought the return for the first ten months of the calendar year to 6.1%, so with only six weeks of 2015 remaining there is a good chance that funds will deliver a fourth consecutive calendar year return.

Listed share markets, both in Australia and overseas, rebounded strongly in October. Australian shares were up 4.4% and hedged international shares surged 8%, while a small rise in the Australian dollar (up from US$0.70 to US$0.71 over the month) meant that the return in unhedged terms was a little lower at 6.3%. Listed property also had a strong month, with Australian and global REITs up 4.9% and 5.6%, respectively.

Chant West director, Warren Chant says: "With the end of the year in sight there remains a good chance that the median growth fund will produce another positive calendar year return. While it won’t reach the heights of the past three years (12.8% in 2012, 17.2% in 2013 and 8.5% in 2014), it would still represent the sixth positive return in the past seven years and the eleventh in the past thirteen.

"Of course one of those negative years was the unprecedented 21.5% loss in 2008. That was at the height of the GFC, but growth funds have bounced back from that setback and now sit about 41% above their pre-GFC high of October 2007.

"A modest positive return for the year shouldn’t come as a surprise. For some time, asset managers have been commenting that we’re heading into a lower return environment. They believe that many asset sectors are now close to being fully valued, and they say they’re finding it harder to identify future sources of growth.

"There were no economic or political surprises in October, and share markets reacted positively to the absence of change. The US Federal Reserve again left interest rates untouched, although it did raise the likelihood of a rate hike in December with a more comforting assessment of the global economy. Expectations of further easing of monetary policy in the Eurozone and Japan also supported market sentiment.

"China, the world’s second largest economy, continues to be the great unknown. A continuing slowdown in growth and mixed economic data over the month resulted in a further interest rate cut, while the official five year growth target has been lowered to 6.5% per annum. Back at home, meanwhile, the Reserve Bank again left the official interest rate unchanged at a record low of 2%."

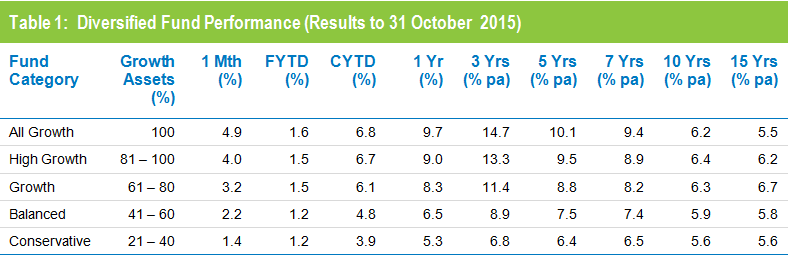

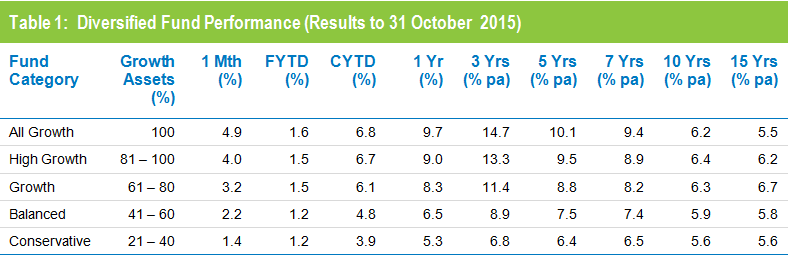

Table 1 shows the median performance for each category in Chant West’s multi-manager survey, ranging from All Growth to Conservative. The three and five year returns reflect the strong performance of listed shares and property, so the more aggressive fund categories, which have a higher proportion invested in those assets, have produced the best performance. The seven year returns have improved significantly as the GFC period has nearly worked its way out of the calculation.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.

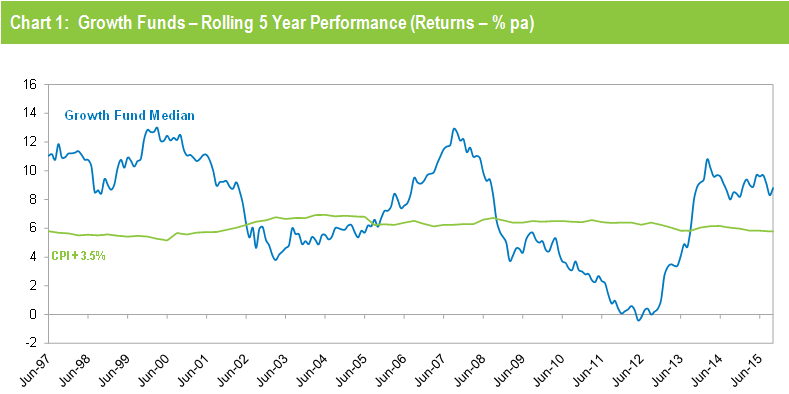

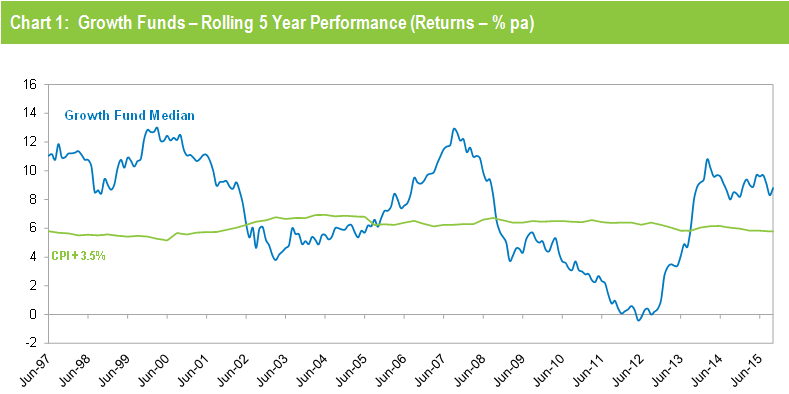

Chart 1 compares the performance since July 1992 – the start of compulsory superannuation – of the Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five year periods). The healthy returns in recent years, combined with the GFC period having worked its way out of the calculation, have seen the five year return rise sharply. For about two years it has been tracking well above that CPI plus 3.5% target.

Source: Chant West

Note: The CPI figure for October 2015 is an estimate.

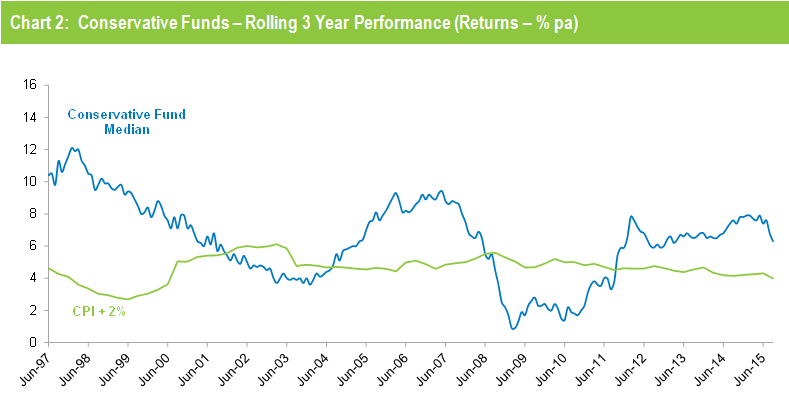

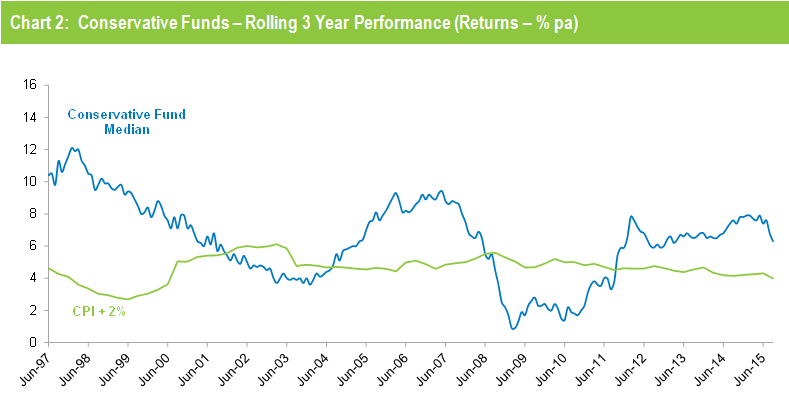

Chart 2 compares the performance of the lower risk Conservative category (21 to 40% growth assets) median with its typical objective of CPI plus 2% per annum over rolling three year periods. It shows that Conservative funds have also exceeded their objective in recent times.

Source: Chant West

Note: The CPI figure for October 2015 is an estimate.

Retail funds take the lead in October

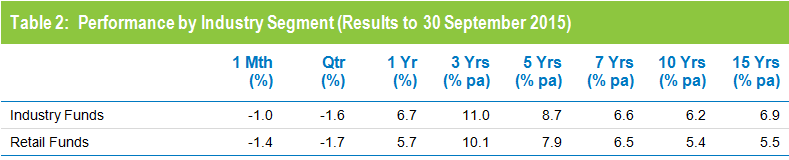

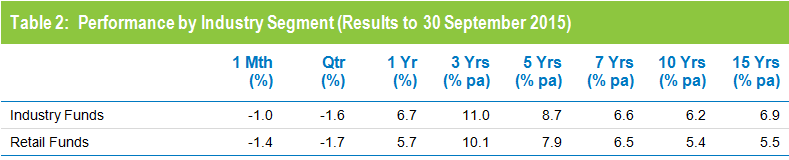

Retail funds outperformed industry funds in October with a return of 3.5% versus 3%. However, industry funds hold the advantage over the longer term, having returned 7% per annum against 5.8% for retail funds over the 15 years to October 2015, as shown in Table 2. However, performance over periods of seven years and less is much closer.

Source: Chant West

Note: Performance is shown net of investment fees and tax. It is before administration fees and adviser commissions.