Thought piece by Luke Barrett, Partner and Head of Superannuation at Gilbert + Tobin

Gilbert + Tobin are a sponsor of the Chant West Super Fund Awards

Big super is under siege in 2025. The last time this happened was during the Hayne Royal Commission. Back then it was predominantly the retail funds being toasted by Hayne’s blowtorch. This time is hitting different though, with industry funds absolutely in the crosshairs.

There’s more scale than ever. Returns and fees are as competitive as ever. Yet sentiment has reversed. Cliches about growing pains and teething problems are tossed around in some circles, while others ask whether the equal-representation rule has passed its use-by date. There is a frenzied focus on super service standards – everything from merging duplicate accounts, handling complaints and processing benefit claims. One wonders whether the heat around greenwashing last year has found a hole in the ozone layer and drifted off, for now.

Against this backdrop, some tempt fate by daring to ask whether a Royal Commission might be coming. The reasons why one may be on the horizon are in the headlines for all to see. The reasons against needing another one are less obvious.

Not enough time since the last Royal Commission

There has only been about 6 years since the Hayne Royal Commission handed down its final report. Those who were involved will remember that the last Royal Commission looked at all misconduct in the ten years prior. Both these factors hint that it may be too soon for another Royal Commission. There hasn’t been enough time for there to be another ten-year look-back. A Royal Commission now would have about half as much to do as the last one, all other things being equal.

Not enough time to assess whether recent reforms have been effective

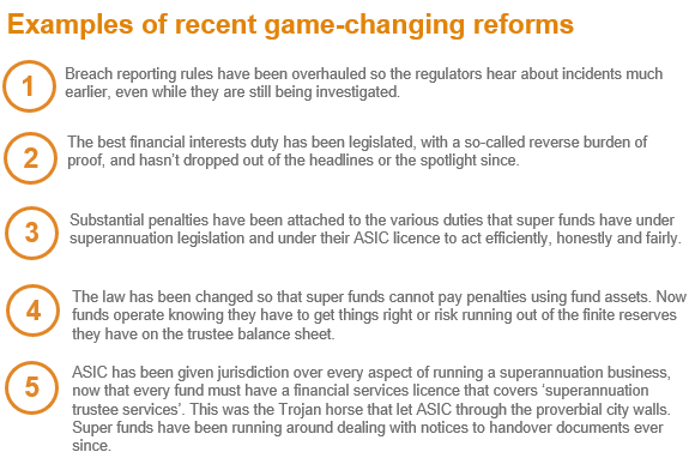

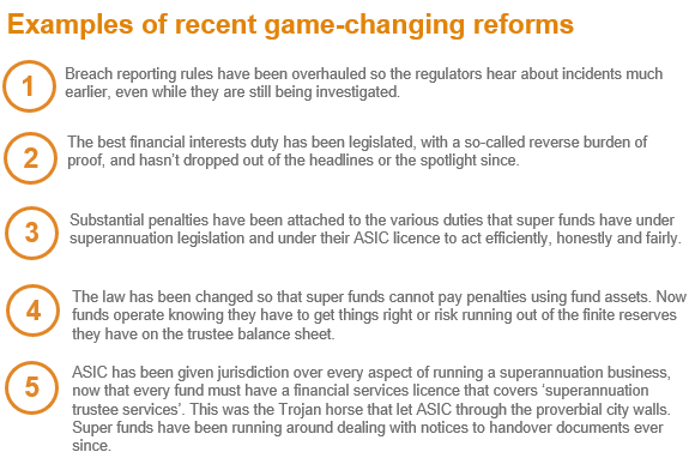

There has been even less time for recent regulatory reforms to make their mark.

Collectively, these were significant reforms that raised the bar and raised the stakes for falling short. They work together to compel and incentivise higher standards through a combination of mandatory requirements with penalties that hurt more than ever before. These reforms should be given time to have their full effect.

We are only starting to see super funds receive super-sized penalties which will have their own motivational and deterrent impacts on service standards and compliance. A recent case concerned failings that persisted for 9 years, but the remediation was fast-tracked in the last 3 years when penalties were introduced. Without confusing causation with correlation, it could be a positive sign that the new penalty regime incentivises superior compliance.

It may be premature for a Royal Commission to comment on whether further reforms are needed, when the long-term impacts of the previous set of reforms are still not known. The recent reforms should first be given a fair chance to achieve what they were designed to achieve.

Further solutions have already been identified

Service standards are at the epicentre of the current super storm. There is already talk of codifying service standards. This would have a major impact if implemented because, currently, the only statutory member service standards are to process rollovers in 3 days and merge duplicate accounts once a year. The most targeted tonic for the system’s supposed ills has already been identified.

There are better ways to investigate issues

We also shouldn’t lose sight of why Royal Commissions are instigated in the first place. The purpose of a Royal Commission is to investigate issues of national importance by leveraging their vast information gathering powers. The issues dominating media headlines now do not need the coercive powers of a Royal Commission in order to be investigated.

Mimicking the spectacle of the Hayne Royal Commission, parliamentary committee hearings have become the new black. The prospect of being hauled before a parliamentary committee hearing is a ubiquitous risk that fund executives must live with nowadays, with politicians and the media ready to pounce on inaccurate or selective non-answers. Against this new status quo, the case for a costly Royal Commission that is expensive for taxpayers and members alike is harder to make.

Equally, regulators now have more levers to carry out their own investigations. ASIC has jurisdiction over super funds and receives vastly superior data on compliance incidents in a much timelier fashion than they did prior to the last Royal Commission. These are not just theoretical factors. Most large funds have experienced a steady surge in ASIC investigations and surveillances in recent years. Investigations are happening. Significant penalties are being imposed. The regulatory system is working.

Unknown unknowns and known unknowns

These are all sound reasons for not having another Royal Commission, yet. That said, there may be other factors which are not publicly known which will sway the course of future events.

There is a political element too. With an approaching Federal election, there would be a non-zero correlation between the election outcome and the prospect of a Royal Commission in the near future.

One way or another though, the next 12 months will likely be a tumultuous time for some funds.

Gilbert + Tobin is on standby to assist super funds navigate these challenges, come what may.