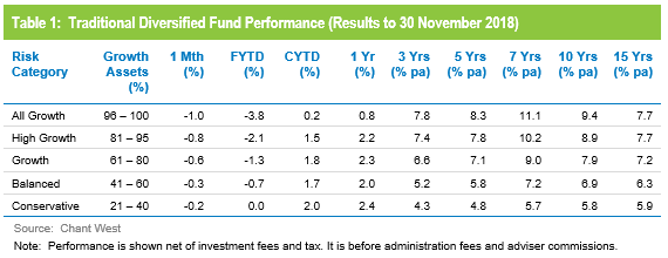

Further share market falls in November are weighing on investment returns, with super funds heading towards a flat calendar year result. The median growth fund (61 to 80% in growth assets) retreated 0.6% in November, pulling back the return for the first eleven months of 2018 to 1.8%. Further sharemarket losses over the first half of December have reduced that figure to an estimated 0.5%.

In November, Australian shares fell 2.2%. International shares were up 1.2% in hedged terms but the appreciation of the Australian dollar over the month (up from US$0.71 to US$0.73) turned that gain into a loss of 1.8% in unhedged terms. Listed property was mixed with Australian REITs down 0.3% but international REITs up 3.6%.

Chant West senior investment research manager Mano Mohankumar says: “Despite the share market falls over the past two and a half months, with two weeks of the year remaining growth funds still have a chance of finishing in the black. However, it’s no sure thing and we may yet see the first negative year since 2011. Whatever happens, this year’s return will be nowhere near the 10% average of the previous six years.

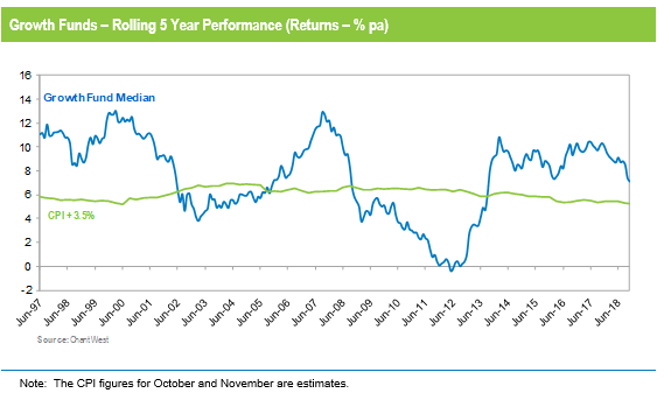

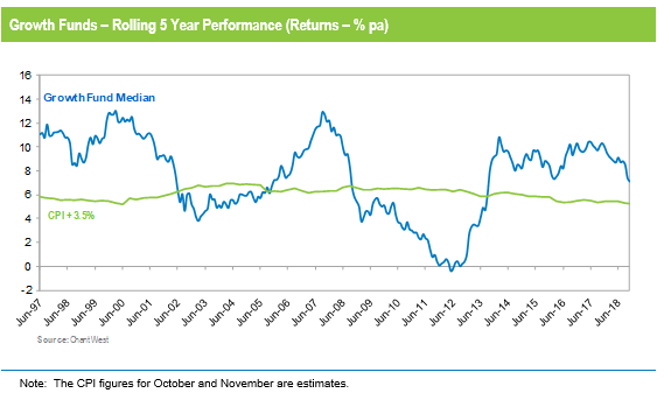

“This flat result doesn’t come as a surprise given the stellar run super funds have experienced since early 2009. Asset managers have been saying for some time that most sectors are now priced at the top of their valuations, or close to it. Members also need to remember that growth funds are generally designed to beat inflation by 3.5% a year, which translates to about 6% per annum over the long term.

“What we’ve seen in recent months is the benefit of diversification coming to the fore, and a reminder that growth fund performance isn’t driven entirely by share markets. On average, growth funds have about 55% of their members’ money in those markets, which leaves 45% invested across a wide range of other sectors, including unlisted infrastructure and property as well as traditional defensive sectors like bonds and cash. This helps cushion the blow when share markets fall. So, while Australian and international shares are down 8.5% and 11.5%, respectively since the end of September, the median growth fund is only down about 4.9%.

“Older members approaching retirement naturally have a lower tolerance for seeing their balances go down than younger members. However, they also tend to be more conservatively invested. Conservative funds (21 to 40% in growth assets) are only down 1.4% since the end of September.

“We encourage members to treat their superannuation as a long-term investment. They should check that the investment option they’re in is suitable for them and, if so, remain patient and not get distracted by short-term noise. Trying to time the market by moving into a more conservative option after sharp share market falls can be detrimental because not only do you crystallise your losses, you also risk missing out on all or part of the subsequent rebound when markets recover.”

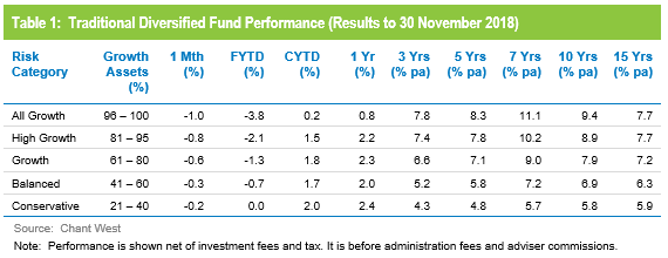

Table 1 compares the median performance for each of the traditional diversified risk categories in Chant West’s Multi-Manager Survey, ranging from All Growth to Conservative.

Lifecycle products behaving as planned

Mohankumar says, “While our Growth category is still where most people have their super, a meaningful number are now in so-called ‘lifecycle’ products. Most retail funds have adopted a lifecycle design for their MySuper defaults, where members are allocated to an age-based option that is progressively de-risked as that cohort gets older.

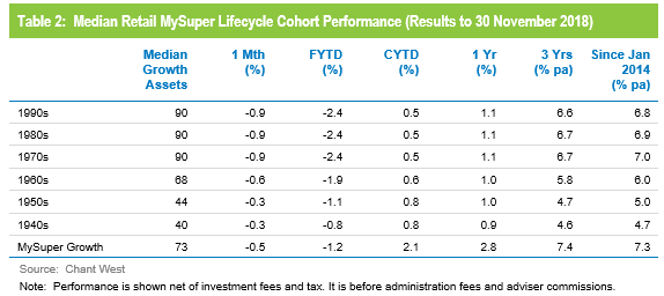

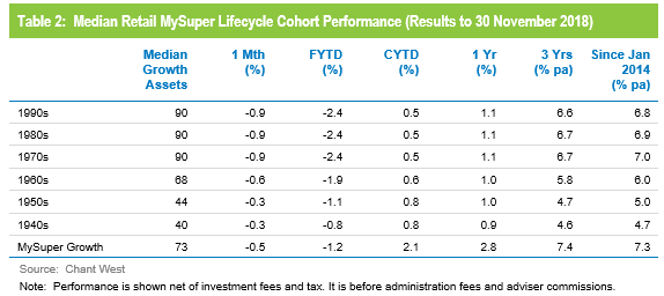

“It’s difficult to make direct comparisons of the performance of these age-based options with the traditional options that are based on a single risk category, and for that reason we report them separately. Table 2 shows the median performance for each of the retail age cohorts, together with their current median allocation to growth assets.”

While lifecycle is the most common MySuper default in the retail sector, most not-for-profit funds still use their traditional growth options for that default role although a few have also gone down the lifecycle path. While the general premise is the same, in the not-for-profit lifecycle model members ‘switch’ from one traditional risk category to another at particular ages. The diversified options that underlie these products are included in Table 1.

To illustrate the early results of the lifecycle model, Table 2 includes a row for these traditional MySuper Growth options – mainly, but not all, not-for-profit funds. Caution should be taken when comparing the performance of the retail lifecycle cohorts with the median MySuper Growth option as they are managed differently so the level of risk varies over time.

The past few years have seen strong performance from growth assets so, as you would expect, the options that have higher allocations to growth assets have done best. Up until two months ago, younger members of retail lifecycle products – those born in the 1970s, 1980s and 1990s – had held their own compared with the median MySuper Growth fund, but had done so by taking on more share market risk. However, as a result of the recent share market falls, their performance now lags the MySuper Growth median over all periods shown in Table 2.

The opposite is true for older members – those born in the 1960s or earlier. These age cohorts are less exposed to share market risk so over the past couple of months they’ve suffered less in the downturn than the younger ones and less than the median MySuper Growth fund. That’s what these products designed to do. Capital preservation is more important at those ages so, while they miss out on the full benefit of rising markets, older members in retail lifecycle options are better protected in the event of a market downturn. That’s working, as is clear from the shorter-term results in Table 2.

Long-term performance remains above target

MySuper products have been operating for less than five years, so when considering performance it is important to remember that super is a much longer-term proposition. The Chart below compares the performance since July 1992 – the start of compulsory superannuation – of the traditional Growth category median with the typical return objective for that category (CPI plus 3.5% per annum after investment fees and tax over rolling five-year periods). Notwithstanding the current downturn, the healthy returns in recent years have seen the longer-term performance tracking well above that CPI plus 3.5% target for the past five years.