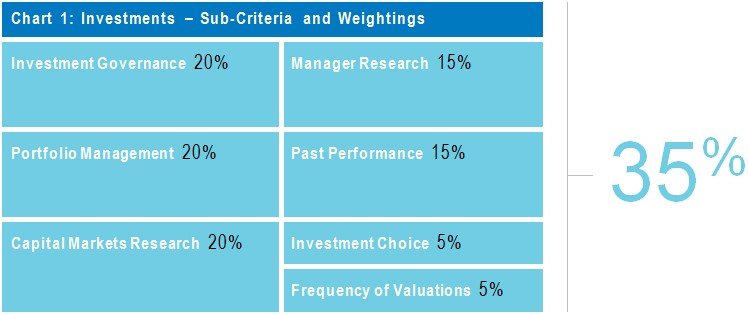

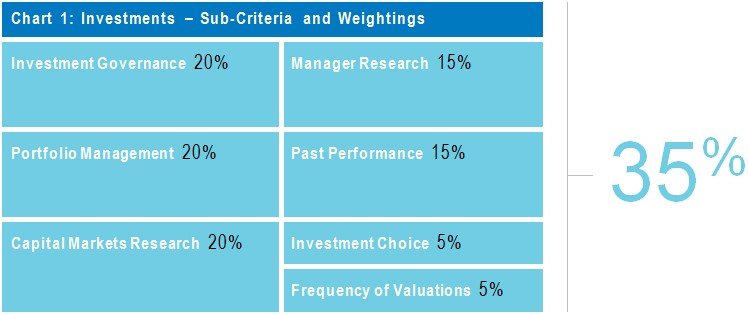

Chant West’s annual Awards night will be held later this month, and investment excellence will feature heavily. While there are other qualities that the best funds need to exhibit, investment is the single most important and it carries the highest weighting (35%) in our fund rating process.

When we assess a fund’s investments we are looking primarily at the quality of its investment governance, capital markets and manager research, asset allocation, portfolio construction and management. Those criteria carry the highest weightings in our scoring system, as shown in Chart 1.

It is worth noting that past performance accounts for just 15% of the total score for investments (which equates to 5.25% of our overall fund evaluation score). Performance is what the member experiences, but behind the numbers are a series of decision-making processes, and it is the quality of the people making those decisions and the execution of those processes that we assess in our ratings.

Long-term performance is what matters in the end, but the long-term numbers are the result of multiple shorter-term decisions and outcomes. High quality governance, people, processes and resources – internal and external – all increase the likelihood of the fund achieving its performance objectives. Most funds look to deliver consistent above-average performance, that will eventually lead to 1st quartile performance over the long term. All of this combined is the essence of good investment.

Internal investment teams continue to grow

The way the major funds go about investment is a dynamic process – it evolves as the industry itself grows and evolves. Contribution flows and investment returns mean that most funds are growing their asset base steadily (particularly the medium to large not-for-profit funds), and increasing scale brings fresh opportunities.

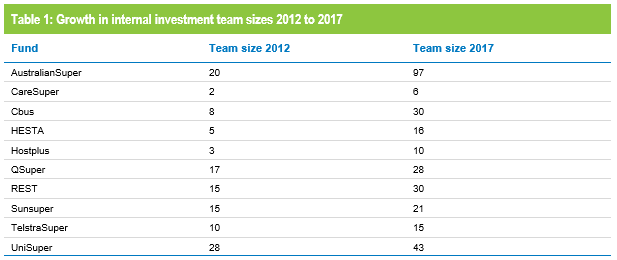

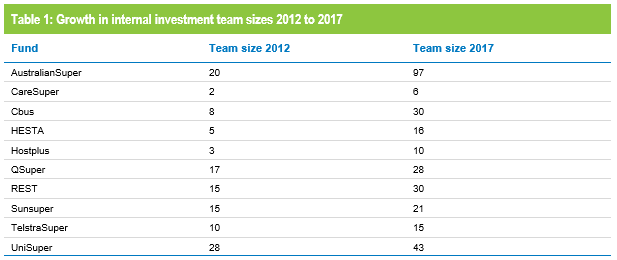

One important development in recent years has been the trend for some of the larger funds to grow their in-house investment capability. This is evident from Table 1, which shows the change over the past five years in the sizes of the internal teams of the 10 finalists in this year’s Best Fund: Investments award category. The team numbers on their own don’t tell us anything about their efficiency and effectiveness. We meet and talk to these teams regularly and, while it is difficult to measure such things, it is clear to us that some of the smaller teams are punching well above their weight.

The internal teams have grown in numbers as funds have increased the depth and scope of their operations, but how these additional resources are being used varies from fund to fund. Some are directly involved in managing money, but in other cases the team members may be doing investment strategy and asset allocation, capital markets research, manager research, exploring new investment ideas and opportunities, conducting due diligence on unlisted assets or preparing briefing papers for their Investment Committee.

Some of this, of course, would in the past have been carried out by an external asset consultant. So while there are still many traditional consulting relationships, especially with smaller funds, for some of the funds with sizeable internal teams the role of the consultant has become far more focused. These funds may retain different consultants for specific areas of expertise. These can range from asset allocation advice to research on emerging managers or the generation of new ideas in portfolio construction and risk budgeting. This has required more flexibility on the part of the established consulting firms and has also paved the way for other firms with niche skills to enter the market.

No 'best' model, but some ideas seem to work well over time

When it comes to portfolio management, there is a refreshing diversity of approaches in how funds go about structuring and managing their portfolios. We can see that simply by looking at the two most recent winners of our Best Fund: Investments Award – AustralianSuper and UniSuper.

AustralianSuper has steadily ramped up its investment team and given it more responsibility for decisions. The fund now uses in-house management for property, infrastructure, Australian shares and more recently international shares and credit. Its investment team is also more active in asset allocation than it was five years ago. AustralianSuper has stayed true to its pioneering nature in exploring ‘new’ asset classes, while its unique scale allows it to invest in massive direct assets, both in property and infrastructure.

UniSuper is a strong believer in active management and has built a formidable team of experienced investment professionals to conduct that management in-house. Under CIO John Pearce and with the oversight of its highly-credentialed Investment Committee, UniSuper now manages 63% of its total assets internally across multiple asset sectors. It prefers to invest in listed markets where its team has the most experience so, unlike AustralianSuper, its exposure to quality property and infrastructure is through listed vehicles such as Scentre, Transurban and Sydney Airports.

Scale is an enabler. Generally, it is the larger funds that have in-house asset management teams, and they do so to exploit several perceived advantages. Firstly, running an in-house team is a relatively fixed cost whereas external manager fees are typically asset-based and therefore increase over time. So managing assets in-house can deliver cost savings. Secondly, in-house management bypasses the capacity constraints that may be encountered with external managers.

Thirdly, there are some asset classes where external managers have difficulty in generating net alpha after fees. If the in-house team is suitably skilled, they may be able to produce similar or better performance at a lower cost.

Scale does appear to deliver results, and in general we find that the larger funds do demonstrate superior performance. In our multi-manager survey article in June

2016, for example, we estimated that the performance differential between large and small funds (defined for the exercise as over or under $10 billion) was about 0.8% per annum over the long term. That said, we still see a number of small funds that are producing very competitive returns and whose investment operations warrant our highest (5 Apples) rating such as Catholic Super, Energy Super and Equip.

In terms of portfolio structure, our view is that there is no ‘right’ model – let alone a ‘best’ model. But we now have enough evidence over long periods to suggest that there are some characteristics that are common to many of the better long-term performers, and those are what we look for when assessing funds on their investments.

One is a meaningful allocation to unlisted assets – primarily property, infrastructure and private equity. We have commented frequently that the contribution these assets make to returns, together with their diversification benefits, more than outweighs the additional management fees that they entail. UniSuper, which has taken the listed asset path to building its property and infrastructure exposure, is a unique case.

Another shared characteristic is belief in the value of active management. All funds are under fee pressure and we recognise that there is a place for low-cost passive management in some asset sectors. What we like to see is judicious use of passive management as part of an overall risk and fee budget, i.e. to allow for active management fees to be spent in areas that are most likely to deliver the ‘best bang for the buck’.

Finally, to performance

Past performance, with a weighting of 15%, is a relatively small factor in our investment ratings. We view short-term performance more as an indicator, i.e. whether the fund is performing as we would expect based on how it invests, rather than as an important assessment criteria.

We tend to focus more on longer-term returns over 7 to 10 years. We do recognise, however, that changes can occur such as restructuring of portfolios, significant moves in the investment team, investment governance regime, asset consultant etc. So we do pay some attention to short- to medium-term performance, especially where we see significant change or anomalies such as the fund not performing as we would expect in the prevailing market conditions.