As super funds evolve we need to be clear about what really makes a difference to member outcomes, in other words the benefits that fund members ultimately receive. We have recently updated our ratings methodology to reflect some important developments, especially those that affect how funds invest.

Every year we re-assess the funds in our ratings database, and these ratings are the starting point for the shortlists for our annual awards. The ratings process is always a time for reflection, and this year we decided to increase the weightings for investments and member services, at the expense of fund administration. The reason is that these two criteria are by far the most important in terms of their influence on member outcomes. In a world where funds are becoming increasingly alike, these are the key differentiators.

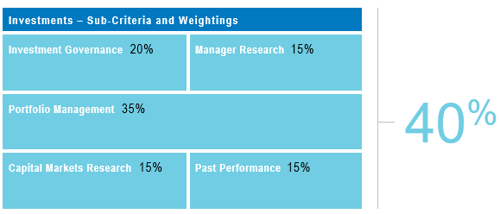

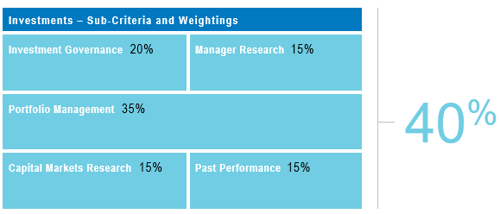

Investments now carries a weighting of 40% in our overall fund assessment, up from 35%. When we assess a fund’s investments we look at the quality of its investment governance, its capital market and manager research, its internal and external resources and – most importantly – its portfolio structure and portfolio management capabilities and processes. Those factors are reflected in our ratings criteria, as shown in the Chart below.

It is worth noting that past performance accounts for just 15% of the total score for investments (which equates to 6% of our overall score for the fund). Performance is what the member experiences, but it is the outcome of a series of decision-making processes. What we are assessing is the quality of the people making those decisions, the structure of their portfolios, the resources they have available and the skill and efficiency with which they implement their processes. We generally find that there is a strong correlation between these factors and good long-term investment performance.

We are not looking for funds to ‘shoot the lights out’ in any given year, because we know that is likely to be unsustainable. Rather, we are looking for the ability to deliver consistent above-average performance, which will eventually translate into 1st quartile performance over the long term. That is the essence of good investment.

MySuper and the temptation to compromise

The advent of MySuper, with its heavy focus on fees, has changed the investment landscape. It has introduced what we believe to be an unwelcome distortion, in that it has tempted funds to invest according to a fee budget and to compromise on what they would otherwise have done.

The extent to which funds have succumbed to the temptation varies, but in our rating process we try to reward funds that have stayed true to their proper purpose – that is, to deliver the best net of fee returns for their members even if that entails incurring higher investment fees and costs in the process.

We want to see funds incorporate as many of their ‘best ideas’ into their portfolios as possible, even if that makes them look relatively expensive in fee comparisons. If they believe, for example, that a significant exposure to unlisted assets is in their members’ best interests, then they should maintain that exposure despite the higher investment fees and costs those assets incur.

The same argument applies to active versus passive management. We believe that active management has been proven to add value over time, especially in Australian equities, and that the additional fees incurred relative to passive have often been justified. Passive or enhanced passive management has its place in some asset sectors, but the lower fees are not in themselves a sufficient justification for increasing the level of passive management in a portfolio. Unfortunately, this is exactly why some funds have gone down the passive route.

Lifecycle strategies present new challenges

Several funds’ MySuper offerings have a ‘lifecycle’ structure. While the designs take different forms, the common idea is for members to take on an appropriate level of investment risk according to their age.

This is a major departure from the traditional ‘one size fits all’ default option where members of all ages typically had a 70/30 allocation to growth/defensive assets (the mid-point of our Growth risk category) for most if not all of their membership. On the other hand, lifecycle members in most cases have a growth asset exposure that might be as high as 85 – 90% at younger ages, and that might not fall below 70% until they are in their 50s. In terms of our categorisation, that means someone joining at 18 may well spend more time invested like a High Growth option rather than a Growth option during the course of their membership.

Lifecycle products introduce some new variables and for us, as researchers, some fresh challenges in how to evaluate and rate them from an investment perspective. For a start, they require that any assessment of investment performance has to take into account multiple risk categories. Someone who spends their entire working lifetime in such a fund will transition through four of our risk categories.

Then there is the design of the products to consider. Some are relatively unsophisticated, switching the member from one risk category to the next as they reach a given age. This is less than ideal, because it results in some fairly abrupt changes in the member’s asset allocation, and the effect of those changes could be quite detrimental depending on movements in investment markets. For example, a significant step-down in equity exposure soon after a major market fall leaves the member with a crystallised loss and a reduced ability to recoup that loss when the market recovers.

Under the so-called ‘cohort’ approach to lifecycle investing favoured mainly by retail funds, members are allocated to a particular investment option (cohort) according to their year of birth and they remain in that option throughout their membership. What changes over time is the asset allocation for that option. The member stays in that option for their age ‘cohort’ which is gradually de-risked.

These age cohorts within the fund are typically in 10 year bands. Although, some providers have 5 year bands. The 10 year band is not ideal, because it means that an individual’s asset allocation is the same if they happen to be born at the end of the age range as at the start. So someone born in, say, 1969 (currently aged 49) has the same asset allocation/growth exposure throughout their membership as someone born in 1960 (currently aged 58). It also means that two people born only a few days apart, say late December 1969 and early January 1970, will have very different allocations throughout their working lives.

In their different ways, these designs introduce a new element of risk. For this reason, we favour funds that have found ways to soften the transition from one asset allocation to another or to remove the significant differences in asset allocations for members of similar ages. We favour 5 year age cohorts over 10 years as this comes closer to the ideal of people of a similar age having a similar glide path.

Some funds that adopt the switching lifecycle approach have come up with more sophisticated answers. QSuper, for one, takes into account the member’s changing account balance as well as their age, with reviews and potential transitions occurring at 6 monthly intervals. Sunsuper uses a different method, which involves a small transfer every month after age 55 from the member’s account in the Balanced pool, with 90% going to the lower-risk Retirement pool and 10% to the Cash pool. By age 65 the member’s entire balance is split 90:10 between the Retirement and Cash pools.

Another innovator is Australian Catholic Superannuation & Retirement Fund, which has recently rolled out its LifetimeOne default strategy for MySuper members. This will change the member’s investment mix every year from about age 40 to age 70, with the growth/defensive split gradually moving from 90/10 to 40/60. It involves moving the member through 31 different asset allocations in the process.

The holy grail of lifecycle investing is to have a tailored portfolio for each member. We expect some funds will make this a reality in the next few years.

As internal teams evolve, so too do asset consultants

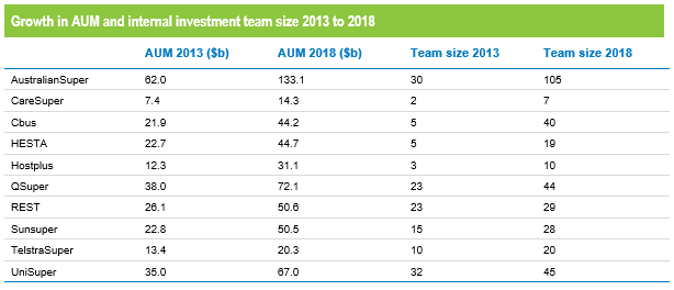

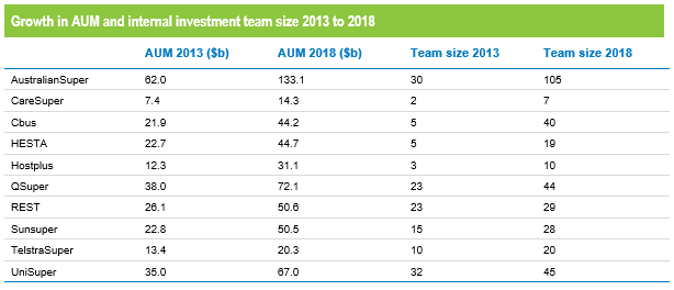

As funds grow in size we are also seeing a trend for them to grow their in-house investment capability. This is evident from the table below, which shows the growth in funds under management and internal investment teams over the past five years for the finalists in this year’s Best Fund – Investments award.

These finalists are all medium to large non-profit funds, and they have roughly doubled their assets under management over the past five years. This increasing scale has enabled them to expand their internal operations, but how these additional resources are being used varies from fund to fund. Some internal teams are directly involved in managing money, but in most cases the focus is more on strategy, asset allocation modelling, capital markets and manager research, due diligence and exploring new investment ideas.

The motivations for developing in-house investment resources differ from fund to fund. One is the desire to have more direct control over the development and implementation of their portfolio management strategy. They may still engage an asset consultant, but they want to be able to do more for themselves. With their increasing scale they have the financial resources to attract and recruit high quality professionals out of funds management and asset consulting roles – and in some cases these are people who are already well acquainted with the fund. We see many instances of investment professionals who simply enjoy managing money for members, rather than having to deal with multiple clients and the other distractions they encountered in their former funds management or consulting roles.

For those funds that choose to manage money internally, costs are one of the motivators. Running an in-house team is a relatively fixed cost whereas external manager fees are typically asset-based and therefore increase over time. Also, there are some asset classes where external management has not generally delivered net alpha after fees, and an in-house team may be able to produce similar performance at a lower cost. Another reason to manage money internally is to avoid the capacity restraints that large funds sometimes encounter when dealing with external managers.

Of course all this means that asset consulting firms have had to evolve too. Most medium to large funds that develop in-house capabilities still have a principal asset consultant, but they come to be less reliant on them. They are more likely to draw on their consultant for specialist resources – or may use a range of specialist consultants for particular projects. So traditional consulting firms have had to become more flexible and to develop key areas of expertise.

With funds’ growing their in-house investment capabilities, there has been an increased need for consultants to move beyond making investment recommendations to clients but to also provide research databases and analytical tools so funds can conduct their own analysis. In recent years, we have seen most consultants invest heavily in systems technology to meet this demand from clients.

As touched on earlier, staff retention has become an issue for consultants given that some of them have been losing talent to their client funds. One solution is to make sure key staff have a stake in the business, and the clearest example of that was the management buy-out of JANA from NAB.

The importance of good governance

We have commented before that, when it comes to portfolio management, there is no ‘best’ model. Every fund has its own investment beliefs, and its own way of structuring and managing its investments. That diversity will be evident when we announce the shortlist of funds for our Best Fund – Investments award this year.

One quality that the best funds exhibit, though, is good governance. Here again, we have witnessed the steady evolution of what we now consider best practice. Until relatively recently, investments were often the responsibility of the full board or a sub-set of the board members with little or no investment experience.

Today, many leading funds include independent experts on their investment committees alongside board members – a practice we encourage. These independents are people with the experience and authority to scrutinise and question proposals put forward either by external consultants or by the fund’s in-house team. They understand the technicalities and can get to the nub of an issue quickly, all of which contributes to good and timely decision-making.